Bajaj Finance share is one of the most talked-about investment options in the Indian stock market. Bajaj Finance Limited, a subsidiary of the Bajaj Finserv Group, is a leading player in the financial services sector. Over the years, it has emerged as one of the most trusted companies for retail loans, insurance, and wealth management. Investors keen on adding high-potential shares to their portfolios often look towards Bajaj Finance share due to its robust market presence and impressive financial performance.

In this article, we will take a closer look at Bajaj Finance share, its performance, why it’s a good investment choice, and what the future holds for this company. Whether you’re a seasoned investor or a beginner looking to diversify your portfolio, Bajaj Finance share offers insights into the financial sector’s potential.

Table Of Contents

- Understanding Bajaj Finance Ltd.

- Key Features of Bajaj Finance Share

- Why Should You Invest in Bajaj Finance Share?

- Bajaj Finance Share Performance and Trends

- Risks and Challenges in Investing in Bajaj Finance Share

- How to Invest in Bajaj Finance Share

- Future Outlook for Bajaj Finance Share

- Conclusion

Understanding Bajaj Finance Ltd.

Bajaj Finance Ltd. was established in 1987 and has become one of the largest non-banking financial companies (NBFCs) in India. The company is involved in various financial services, including consumer finance, SME loans, and commercial lending. It also offers wealth management products and insurance services. The consistent growth of Bajaj Finance share can be attributed to the company’s innovative business model, strategic partnerships, and a diverse product portfolio that caters to both individuals and businesses.

Key Features of Bajaj Finance Share

Bajaj Finance share stands out in the stock market due to its strong fundamentals. Below are some key features that make Bajaj Finance share an attractive investment:

Strong Financial Growth

One of the primary reasons investors consider Bajaj Finance shares is the company’s consistent growth in earnings and revenue. Bajaj Finance Ltd. has maintained impressive growth in its quarterly results, which has significantly boosted investor confidence in Bajaj Finance shares. The company has a strong credit rating and enjoys a leadership position in the lending space.

Diversified Portfolio

Another factor contributing to the success of Bajaj Finance share is its diversified portfolio. Bajaj Finance offers a wide range of products, including personal loans, business loans, home loans, and insurance products. This diversification helps the company mitigate risks and ensures steady revenue streams, making Bajaj Finance share a stable investment.

Robust Business Model

Bajaj Finance operates with a robust business model that focuses on customer-centric offerings. The company utilizes advanced technology and data analytics to assess credit risk, enabling it to make informed lending decisions. This approach has enhanced the financial stability of Bajaj Finance and is reflected in the performance of Bajaj Finance shares in the market.

Why Should You Invest in Bajaj Finance Share?

There are several reasons why Bajaj Finance shares is an excellent investment choice. Below are some of the compelling reasons why investors should consider adding Bajaj Finance shares to their portfolio:

Consistent Returns

Over the years, Bajaj Finance shares has provided attractive returns to its investors. The stock has consistently outperformed many of its peers in the financial services sector, with a strong track record of delivering growth and dividends. The consistent performance of Bajaj Finance shares is a testament to the company’s operational efficiency and growth trajectory.

Excellent Risk-Reward Ratio

When compared to other financial stocks, Bajaj Finance shares offers an excellent risk-reward ratio. The company has a well-diversified product offering, which reduces dependency on any single business vertical. This diversification ensures that even in times of market uncertainty, Bajaj Finance shares continues to perform well, making it a relatively safer investment choice in the financial sector.

Leading Player in Financial Services

Bajaj Finance is one of the most well-established and trusted financial companies in India. The company is a market leader in various segments, including consumer finance, lending, and wealth management. As India’s middle class continues to grow and demand for financial services increases, Bajaj Finance shares stands to benefit from this trend.

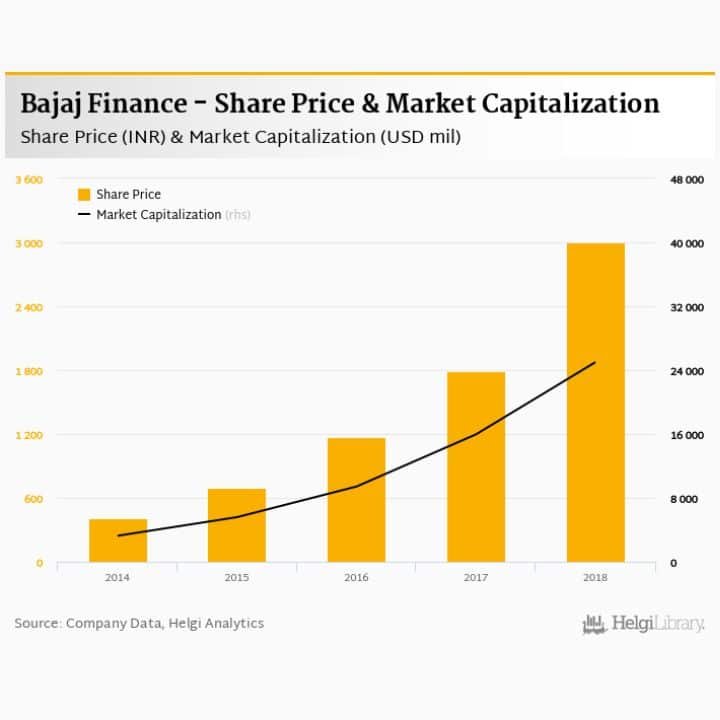

Bajaj Finance Share Performance and Trends

The performance of Bajaj Finance shares has been remarkable over the years. The stock has shown substantial growth and has been one of the best performers in the financial sector. Below is a table showing the historical performance of Bajaj Finance shares:

| Year | Share Price (Start of Year) | Share Price (End of Year) | Annual Growth (%) |

| 2019 | ₹3,300 | ₹4,000 | 21.21% |

| 2020 | ₹4,000 | ₹6,200 | 55.00% |

| 2021 | ₹6,200 | ₹7,500 | 20.97% |

| 2022 | ₹7,500 | ₹8,500 | 13.33% |

| 2023 (YTD) | ₹8,500 | ₹10,000 | 17.65% |

As seen in the table above, Bajaj Finance shares has delivered steady growth in the past few years, making it a reliable investment for long-term investors. While past performance is not always indicative of future results, Bajaj Finance shares has consistently shown strong growth, which is a good sign for potential investors.

Risks and Challenges in Investing in Bajaj Finance Share

Despite its impressive growth, Bajaj Finance shares is not without risks.

Economic Downturns: Bajaj Finance, like any other financial institution, is susceptible to economic cycles. A slowdown in economic growth can lead to higher defaults on loans, which could negatively impact Bajaj Finance shares prices.

- Regulatory Risks: The financial sector is highly regulated, and changes in government policies or regulations can impact Bajaj Finance shares. It is important for investors to keep an eye on any policy changes that might affect the company’s operations.

- Competitive Landscape: The financial services industry is highly competitive, with many players vying for market share. Bajaj Finance shares could face competition from other NBFCs and banks, which could affect its profitability and market position.

How to Invest in Bajaj Finance Share

Investing in Bajaj Finance shares is straightforward. Here’s how you can invest:

- Open a Demat and Trading Account: To buy Bajaj Finance shares, you need a Demat and trading account with a registered stockbroker. You can open an account with any reputable brokerage firm.

- Research the Stock: Before investing, make sure to research the stock thoroughly. Keep track of the company’s financial reports, news, and market trends.

- Buy the Shares: Once you’ve done your research, you can place a buy order for Bajaj Finance shares through your trading platform.

- Monitor Your Investment: After purchasing Bajaj Finance shares, monitor the stock’s performance and stay updated on any news related to the company.

Future Outlook for Bajaj Finance Share

The future outlook for Bajaj Finance shares is positive, driven by several factors:

- Growing Demand for Financial Services: As India’s economy grows, the demand for retail loans, business loans, and financial products will increase. This will benefit Bajaj Finance, which has a diversified product offering.

- Technological Advancements: Bajaj Finance continues to invest in technology and data analytics, which will enhance its lending processes and improve operational efficiency.

- Strong Market Position: As a leading player in India’s financial services sector, Bajaj Finance shares is well-positioned to capitalize on the growing demand for financial products and services.

Conclusion

Bajaj Finance shares offers an excellent opportunity for investors seeking long-term growth in the financial services sector. With its strong financial performance, diversified product portfolio, and leadership position, Bajaj Finance shares is one of the most promising stocks in India. While there are risks involved, the company’s solid track record, combined with India’s growing demand for financial products, makes Bajaj Finance shares a worthwhile investment.

Whether you are a new investor or an experienced one, Bajaj Finance shares is an excellent option to consider for portfolio diversification. As always, ensure that you conduct thorough research and seek professional advice before making any investment decisions.